If you're a high-income professional, executive, or business owner, you've likely maxed out your retirement plans, made your charitable donations, and are still staring down a painful tax bill.

What if there was a legal, IRS-sanctioned way to deduct 60-80% of a six-figure investment against your W-2 income, in the same year?

Welcome to the world of Oil & Gas Intangible Drilling Costs (IDCs). This little-known section of the tax code delivers a rare "above-the-line" deduction against ordinary income - and it's one of the last remaining real-time tax shelters that doesn't require a massive business, real estate empire, or fancy trust work.

🔍 What Are Intangible Drilling Costs (IDCs)?

In oil and gas operations, expenses are divided into two categories:

| Cost Type | Examples | Tax Treatment |

|---|---|---|

| Tangible Costs | Equipment, casing, and rigs | Capitalized and depreciated |

| Intangible Drilling Costs (IDCs) | Labor, drilling fluids, site prep, surveys | Immediately deductible under IRC §263(c) |

When you invest in a qualified oil & gas drilling partnership, your share of the IDCs can be deducted in full in the year incurred, often amounting to 60-85% of your original investment.

And here's the kicker: If the investment is structured correctly, these deductions can be used to offset W-2 income or other active income.

💼 Real-World Example

Client: 49-year-old tech executive in California

AGI: $1.1M

Marginal Tax Rate: 37% Federal + 13.3% CA

Investment: $150,000 in an oil & gas drilling program

IDC Deduction: $115,000 in year one

Tax Savings: ~$58,000

Net cash at risk: $92,000 instead of $150,000

Even if the well underperforms, the tax savings reduce the break-even point, making this an unusually efficient play for diversification and tax mitigation.

🎁 Why It's So Powerful: An Above-the-Line Deduction Against Ordinary Income

Most alternative investments (like real estate or private equity) are passive in the IRS's eyes. Their losses can only offset passive income, which limits their usefulness for high-income earners with W-2 or self-employment income.

But IDCs are different.

When properly structured:

- The loss is treated as non-passive

- It is deductible against W-2 income, 1099 income, and business profits

- No need to qualify as a Real Estate Professional or juggle depreciation schedules

✅ Structure Matters: Working Interest vs. Passive Partnership

To access this deduction, your investment must meet two IRS requirements:

- You must invest in a "Working Interest"

Per IRC §469(c)(3):

A taxpayer's interest in oil or gas as a working interest shall not be treated as a passive activity, regardless of material participation, if the taxpayer holds the interest directly or through an entity that does not limit liability. - No Limited Liability Shield

That means:- No investing through a limited partnership (LP)

- No LLCs where your role is passive

- You must be personally liable for the costs and operations of the well

This is not for the faint of heart, but this lack of liability protection is what enables the tax benefit.

❓What About Material Participation?

Here's where it gets interesting.

Usually, to deduct losses against ordinary income, the IRS requires that you materially participate in the business under one of seven tests (e.g., 500 hours per year, significant participation, etc.).

But with oil & gas working interests, that requirement is waived if you meet the two criteria above.

So even if you don't materially participate, your IDC loss can still be treated as active, provided you're directly involved in a working interest without limited liability.

That's what makes this strategy so unusual - and so powerful.

🧾 Reporting: How It Shows Up on Your Tax Return

- The drilling program issues a Schedule K-1 to you

- IDCs flow through as ordinary losses (often in Box 1 or Box 13J)

- Deducted on Schedule E, and ultimately flows through to Form 1040 above the line

🚧 Risks and Considerations

Let's be clear - this is not a conservative municipal bond.

Risks include:

- Principal loss: The well may produce less than expected, or be dry

- No liquidity: These are long-term, illiquid investments

- Joint liability: You may be on the hook for operating expenses

- Audit risk: You need strong documentation and a clean structure

That said, for the right client, the after-tax ROI can be significantly better than traditional alternatives.

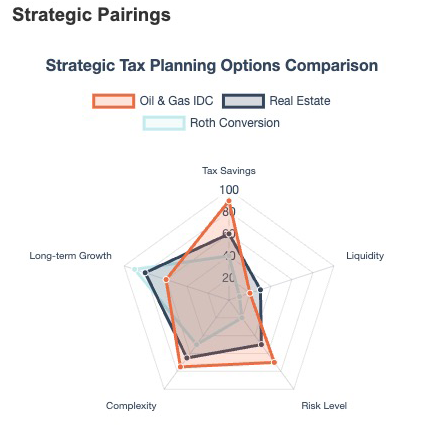

🔁 Smart Pairings and Advanced Planning Ideas

Want to turn this into a strategic powerhouse?

Pair the IDC deduction with:

- 🔁 Roth conversions: Offset the tax on large conversions while locking in tax-free growth

- 🛑 Cash Balance Plan freeze: Reduce required contributions in low-cash years and redirect funds into oil & gas

- 🎯 Donor-Advised Fund: Stack a large DAF gift in the same year to push AGI even lower

- 🏠 Real estate syndications: Add depreciation-based shelters in future years for continued passive loss stacking

🧠 Who Is This For?

This strategy is best for:

- Tech executives with RSU windfalls or liquidity events

- Business owners looking to reduce AGI in peak years

- High-income professionals who've already maxed out: 401(k) + profit-sharing, Backdoor Roths, Cash Balance Plans, DAFs

- Clients willing to accept measured investment risk in exchange for immediate tax efficiency

🎯 Bottom Line

The Oil & Gas IDC deduction is one of the most powerful and underused tax planning strategies available to high-income individuals today. When structured correctly, it allows you to legally deduct 60-85% of your investment against W-2 or business income, providing real-time tax relief while building exposure to a non-correlated asset.

It's not for everyone. But if you're paying six figures in tax each year and looking for creative solutions beyond the basics, this strategy deserves a place in your advanced planning toolbox.

📩 Let’s talk before your next estimated payment is due.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)