Same investments. Different accounts. Drastically different tax bills.

Welcome to the Hidden Alpha Edition of our Boring Investment Strategy Series – where we break down the quiet, repeatable moves that actually build wealth over time. Today's concept is a lot of investors get wrong:

What Is Asset Placement?

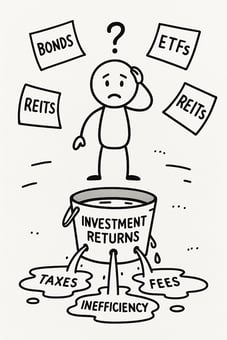

Most investors spend their time thinking about what to invest in – stocks, bonds, ETFs, funds.

But smart investors also think about where those investments go.

Asset placement is the practice of putting tax-inefficient investments (like bonds and REITs) inside tax-sheltered accounts – and keeping tax-efficient assets (like index funds or ETFs) in taxable brokerage accounts.

Here's the basic logic:

Tax-inefficient assets throw off lots of ordinary income (think: bond interest, REIT distributions).

So you place those inside an IRA, 401(k), or other tax-advantaged account – where those earnings are sheltered from taxes.

Tax-efficient assets like total market index funds or ETFs generate less taxable income.

So it's fine (and often optimal) to hold them in a regular brokerage account.

The result? Lower tax drag and a higher after-tax return – without changing what you own.

Why It Works: Reduce the Tax Drag

Some investments run quietly in the background. Others behave like clunky old software — always popping up, slowing things down, and demanding attention from the IRS.

Asset placement puts the noisy tax assets in a quiet room – a tax-sheltered account – so they can't disturb your return.

And that tax efficiency adds up.

Estimated Alpha from Asset Placement: +0.23% to +0.75% annually

(According to Vanguard and Morningstar)

The Mistake Most Investors Make

They scatter their portfolio randomly across accounts.

A little of everything in every account – with no regard for tax treatment, income type, or account purpose.

If your portfolio is spread like peanut butter across accounts, you’re probably leaking return without realizing it.

It’s not about owning different things. It’s about owning the same things in the right place.

How to Apply Asset Placement in Real Life

- Bonds, REITs, high-turnover funds: Put these in IRAs or 401(k)s when possible.

- Index funds, ETFs, stocks: These often belong in taxable accounts due to lower ongoing tax costs.

- Roth IRAs: Great for high-growth assets with long-term upside – because withdrawals are tax-free.

Every account type has a job. Assign your investments accordingly.

Final Thoughts

Asset placement won’t win you cocktail party bragging rights. It won’t make the cover of Forbes. But it’s one of the simplest, smartest ways to get more out of the portfolio you already have.

Same investments. Better outcome.

Don’t just invest smart. Invest where it counts.

💼 Want Help Placing the Right Assets in the Right Accounts?

Most investors focus on what they own—but smart investors focus on where they own it. If your portfolio isn’t built with asset placement in mind, you could be giving up returns you didn’t have to lose.

At VIP Wealth Advisors, we build portfolios with intentionality—balancing tax efficiency, account purpose, and long-term strategy. Let’s make sure your investments are pulling their weight.

📅 Book Your Free Portfolio Strategy Call

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)