Financial independence removes constraints, but fulfillment in retirement only comes from intentionally rebuilding structure, purpose, and connection.

Key Takeaways

- Emotional restlessness in retirement is common and predictable, especially for high achievers.

- The core challenge is not boredom, but the sudden loss of structure, identity, and momentum.

- Busyness alone rarely satisfies without a deeper sense of alignment and purpose.

- Thriving retirees choose intentional trajectories rather than simply filling time with hobbies.

- Community, contribution, and growth matter as much as financial security.

For many high achievers, early or well-funded retirement is supposed to be the finish line. You did the hard part. You built the business, climbed the ladder, managed the risk, saved aggressively, invested wisely, and exited on your terms. Financial independence achieved.

And yet, once the initial relief wears off, a surprising number of people find themselves asking a quiet, uncomfortable question:

Now what?

Not because they lack options. Not because they need money. But because something feels missing.

This emotional restlessness is rarely talked about, even among financially sophisticated circles. It is not a failure of planning or ambition. It is a predictable psychological response to the sudden removal of structure, identity, and momentum that work once provided.

This article explores why this happens, why common solutions often fall flat, and how financially free individuals can navigate retirement with intention, meaning, and clarity.

The Problem Is Not Boredom. It Is the Loss of the Arena.

Most people assume the challenge of retirement is filling time. In reality, the deeper issue is the loss of the arena.

Work was never just about income. For high achievers, it provided:

- Identity

- Daily structure

- Feedback loops

- A sense of progress

- A community of capable peers

- A place where effort visibly mattered

When work disappears, all of that vanishes at once.

What remains is freedom, but also silence.

The calendar clears. The inbox quiets. No one is waiting on decisions. No metrics are tracking progress. No one urgently needs you today.

That can feel liberating for a while. Then it can feel disorienting.

Early retirement does not remove problems. It removes structure. And without intentional replacement, restlessness often follows.

Many financially independent individuals do not miss work itself. They miss being in motion. They miss being tested. They miss knowing what a good day looks like.

Why Staying Busy Rarely Solves the Problem

The first instinct for many retirees is to stay busy.

They explore consulting. They consider buying a small business or franchise. They join boards. They entertain advisory roles. They look for something productive to fill the hours.

And then, just as quickly, they pull back.

Once they visualize the day-to-day reality, many realize they would be recreating the very constraints they worked so hard to escape. Another calendar. Another obligation. Another set of expectations.

Without a compelling internal reason, these pursuits feel like self-imposed prisons rather than opportunities.

The issue is not activity. It is alignment.

Busyness without purpose feels hollow. Productivity without meaning feels like drift. When the why is unclear, even interesting opportunities lose their appeal.

This is why so many financially free individuals find themselves paradoxically both busy and dissatisfied.

High Achievers Need Trajectories, Not Hobbies

One of the clearest patterns among people who thrive in retirement is this:

They do not simply fill time. They choose a trajectory.

Hobbies are enjoyable, but they are finite. A trajectory has direction, challenge, and evolution. It creates forward momentum without putting financial pressure on.

Common trajectories that resonate with high achievers include:

- Mastery: Learning a new skill deeply, not casually. Languages, music, athletics, philosophy, craftsmanship.

- Contribution: Mentoring, teaching, volunteering, advising without income dependency.

- Community: Being embedded in groups of motivated, curious, capable people.

- Physical progression: Training toward events, competitions, or long-term health goals.

- Creative output: Writing, building, designing, teaching, or sharing accumulated wisdom.

The key difference is intentionality.

These pursuits are not about passing time. They are about becoming someone new.

Retirement is not the absence of progress. It is the freedom to redefine what progress means.

The Ego Trap of Starting Over

One of the least discussed challenges of retirement is ego.

High achievers are accustomed to competence. They spent decades mastering their craft, building credibility, and operating at a high level. Starting something new means being a beginner again.

That can be uncomfortable.

True mastery requires being bad at something for a long time. It requires humility, patience, and delayed gratification. There is no title, no immediate validation, no clear scoreboard.

As a result, many retirees default back to familiar skill sets. Investing. Advising. Consulting. Board roles. While intellectually stimulating, these often fail to provide the visceral feeling of being in the arena.

Over time, people can feel like observers rather than participants.

Growth in this phase of life does not require more ambition. It requires ego flexibility.

Independence Is Not the Same as Connection

Another consistent insight is the importance of community.

The happiest retirees rarely operate in isolation. They mention mentoring relationships, volunteer work, teaching, local involvement, or participation in groups with shared values and curiosity.

Humans calibrate themselves socially. Without regular interaction with other motivated people, even unlimited freedom can quietly turn into isolation.

Being there when needed often feels more fulfilling than being constantly busy. Contribution does not require obligation to be meaningful.

Community provides relevance without pressure. Belonging without hierarchy. Purpose without income dependency.

This is especially important for individuals who spent much of their adult life surrounded by capable peers and fast-moving environments.

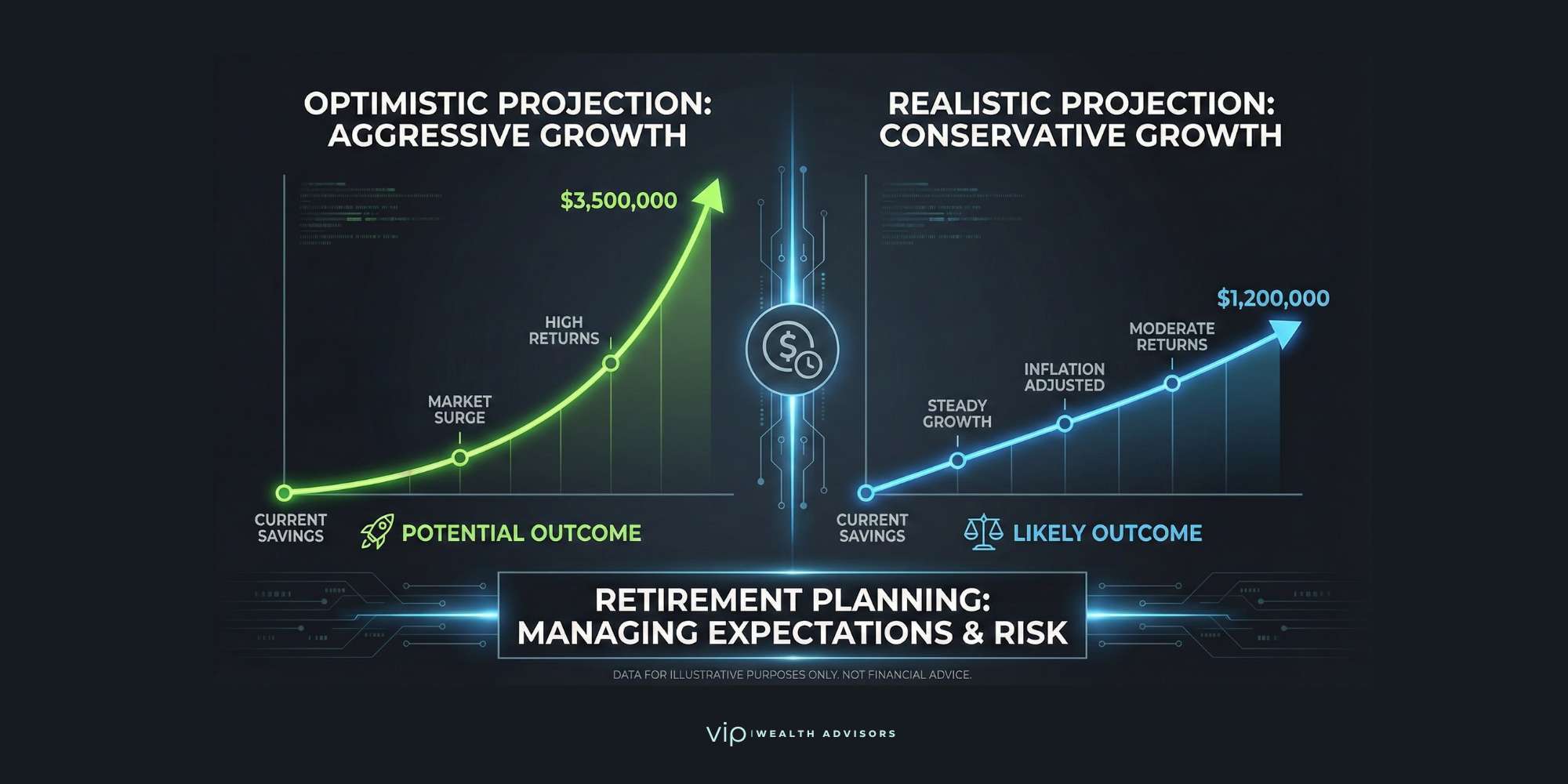

Rethinking What Retirement Planning Really Means

Traditional retirement planning focuses almost exclusively on numbers.

- Can you retire?

- Will the money last?

- What is the withdrawal rate?

- How is the portfolio allocated?

Those questions matter. But for high-net-worth individuals, they are only the beginning.

Sophisticated planning must also address:

- Identity transitions

- Use of time

- Psychological readiness

- Purpose and structure

- The emotional reality of freedom

The best outcomes occur when financial independence is paired with intentional life design.

The question is not just whether you can retire. It is whether you know what you are retiring into.

A Practical Reflection Framework

If you are financially free and feeling restless, consider reflecting on the following:

- Which parts of my working life energized me most?

- Which parts did I tolerate rather than enjoy?

- Where do I want to grow, not just spend time?

- Who do I want to be in community with?

- What would a good week look like one year from now?

- What would make me feel useful without feeling trapped?

These are not questions with immediate answers. But they are the right questions.

From Financial Freedom to Intentional Living

Early retirement does not come with a script. That is both the risk and the gift.

Feeling restless does not mean you failed. It means you are being deliberately asked to author the next chapter.

This stage of life is not about proving anything. It is about choosing what matters now, without having to choose based on money.

Financial freedom removes constraints. Meaning comes from what you build in their place.

And for those willing to engage honestly with that question, this chapter can be the most intentional and fulfilling one yet.

Common Questions About Emotional Restlessness in Retirement

+Why do so many early retirees feel bored or restless?

Because work provided structure, identity, and feedback. When those disappear overnight, the absence can feel disorienting even when finances are secure.

+Is boredom in retirement a sign that I retired too early?

Not necessarily. It is often a sign that the non-financial aspects of retirement were underplanned.

+How do high achievers find purpose after retirement?

By choosing intentional trajectories such as mastery, contribution, community, or creative output rather than simply filling time.

+Are hobbies enough to feel fulfilled in retirement?

For some people, yes. For many high achievers, hobbies alone lack direction and long-term challenge.

+What replaces the sense of identity work provided?

Identity can shift toward who you are becoming, who you help, or what you are building rather than what you earn.

+How can retirees create structure without going back to work?

By committing to pursuits with goals, accountability, and progression without financial dependency.

+Why does consulting often feel unsatisfying after retirement?

Because it can recreate obligation without providing the deeper meaning or momentum people seek.

+What role does community play in retirement happiness?

A significant one. Connection with motivated peers provides relevance, feedback, and a sense of belonging.

+Is it normal to feel lost after selling a business or exiting a career?

Yes. The loss of a central organizing force in life often triggers a period of recalibration.

+How should financial planning address life after retirement?

By incorporating discussions about time, identity, purpose, and emotional readiness alongside financial strategy.

+What does a successful early retirement actually look like?

One that balances freedom with intentional growth, contribution, and connection.

+How can a financial advisor help with the non-financial side of retirement?

By acting as a thought partner who helps clients think holistically about life design, not just portfolio design.

Planning for Retirement Is Not Just About Money

If you are financially independent but questioning what comes next, this is not a problem to solve alone. The transition from accumulation to intentional living deserves the same level of thought and clarity as your financial plan.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)