Introduction: Is a Financial Advisor Worth It?

If you're a high-income earner, business owner, or someone with complex financial needs, you've probably asked:

"Is it worth paying a financial advisor thousands of dollars a year?"

Here's the truth: With the right advisor, the return on investment (ROI) is not only measurable but also substantial. Studies show that high-value financial advice can add 3–5% annually to your long-term returns, not just in your portfolio but across your entire financial life.

This article breaks down exactly why working with a flat-fee, tax-savvy, boutique advisor is often the smartest money move you'll make — and how traditional advisory models fall short.

Not All Financial Advisors Are Created Equal

The financial services industry has a dirty secret: Most advisors are overburdened and underdelivering.

At many firms, especially those with flashy marketing and VC funding, a single advisor may be assigned to 175 to 250 clients or more. These firms often run on a "factory model," built for scale — not personalization.

The result? Cookie-cutter financial plans, poor communication, reactive service, and little-to-no tax coordination.

The Flat-Fee, White-Glove Alternative

Contrast that with a boutique flat-fee advisor who caps their practice at ~55 households. Here's what that relationship looks like:

- Transparent pricing not tied to your asset levels

- Annual tax preparation and integrated tax planning

- Equity compensation strategy for RSUs, ISOs, and ESPPs

- Ongoing planning, not just yearly reviews

- Proactive communication — not just when you call

When you're paying a flat annual fee based on complexity, not portfolio size, the value becomes clear:

| Portfolio | 1% AUM Fee | Flat-Fee Equivalent |

|---|---|---|

| $1M | $10,000 | $10,000 |

| $2M | $20,000 | $10,000 - $15,000 |

| $3M | $30,000 | $15,000 - $20,000 |

📊 You get more service — and more savings — for less.

The ROI of Real Advice: Advisor Alpha in Action

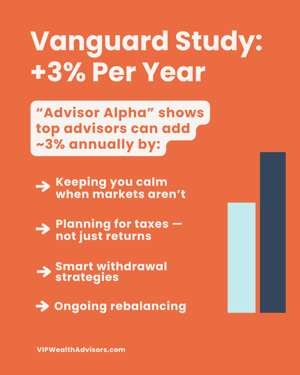

Vanguard: Advisor Alpha Adds 3%

Vanguard's study on "Advisor Alpha" found that great advisors can add about 3% in net annual value through:

- Behavioral coaching

- Tax-efficient strategies

- Withdrawal optimization

- Rebalancing

Russell Investments: Nearly 5% Added Annually

Russell Investments estimates that a financial advisor can add 4.91% annually, factoring in:

- Customized planning

- Tax loss harvesting

- Avoiding emotional decisions

Multiply those gains over 10–20 years, and the compounding impact is massive — well beyond the cost of a quality advisor.

The True Cost of AUM Fees

Most advisors still charge a percentage of assets under management (AUM). The problem? As your wealth grows, so does your fee — whether or not your service improves.

A $2.5M portfolio at a 1% fee = $25,000/year. Yet you may receive:

- No tax return prep

- Surface-level investment advice

- Little help with equity comp or business strategy

Flat-fee advisors decouple cost from assets, delivering consistent, comprehensive value regardless of market swings.

Hidden Fees: The Silent Portfolio Killer

Even if you're working with an advisor charging 1%, you may be paying another 1–1.5% in hidden costs within your investments:

- Mutual fund expense ratios often exceed 1%

- 12b-1 fees (marketing and distribution costs)

- Tax drag from poorly timed capital gains

Here's what the true cost often looks like:

| Investment Type | AUM Fee | Expense Ratio | Total Cost |

|---|---|---|---|

| Mutual Fund Portfolio | 1.00% | 1.25% | 2.25% |

| Flat-Fee + Low Cost ETFs | Flat $15,000 | 0.05% | ~0.60% |

On a $2.5M portfolio, that difference can save you $40,000+ per year.

Red Flags in Today’s Advice Landscape

Before hiring an advisor, ask:

- How many clients does each advisor manage?

- Do they prepare taxes or just "coordinate"?

- Are they responsive and proactive?

- Can they handle equity comp, small business planning, or high-net-worth tax complexity?

Be cautious of firms with advisor-client ratios above 100:1. These firms often include:

- Faceless tech portals

- Generic reports

- Delayed communication

- Advisors stretched far too thin to be strategic

The Real Value: Outcomes, Not Hours

When you hire a top-tier flat-fee advisor, you're not paying for time — you're paying for results:

- Smarter stock option decisions (ISOs, RSUs)

- Lower tax bills

- Coordinated estate and business planning

- Optimized charitable giving

- Better decision-making during volatility

The right advisor helps you avoid 6-figure mistakes — while adding long-term structure and confidence.

Final Thought: It's Not About Cost, It's About Value

Paying $10,000 to $20,000 per year may seem steep — until you realize that a smart advisor:

- Pays for themselves in tax savings

- Adds compounding value through better decisions

- Saves you from emotional mistakes

- Gives you peace of mind and time back

The best financial advice doesn't cost you money; it makes you money.

Ready to See What a Boutique Flat-Fee Advisor Can Do for You?

If you’re a high-income professional, equity-compensated executive, or business owner ready for deeper, smarter financial advice — let's talk.

Because real advice isn’t mass-produced; it’s tailored, proactive, and built around you.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)