Annuities are one of the most aggressively marketed financial products in the U.S. They are often pitched as simple, safe solutions for lifetime income, principal protection, or tax deferral.

But simplicity is not what you get when you read the fine print. Behind the brochures are complex insurance contracts with layered fees, restrictions, and conflicts. They can fit in narrow situations, but for most high earners and business owners, there are more efficient, flexible ways to reach the same goals.

Quick Answer: Annuities are insurance contracts that trade liquidity for guarantees. For most high earners, high fees, ordinary income taxation, and surrender charges reduce long-term returns. They may make sense only if you have already maxed out 401(k)s and IRAs and want lifetime income with low market risk.

Are Annuities Worth It for High Earners?

For most high-income professionals and business owners, annuities represent a more costly and less flexible alternative to other investment strategies.

What Is an Annuity and How Does It Work?

At its core, an annuity is a contract between you and an insurance company. You invest a lump sum or make periodic contributions, and in return, the insurer promises:

- Growth of your funds on a tax-deferred basis until withdrawal.

- Optional lifetime income payments (either immediate or in the future).

- The possibility of add-on benefits, such as death benefits or guaranteed withdrawal riders.

Unlike 401(k)s or IRAs, annuities are not tax-qualified accounts; they are private contracts. The IRS taxes withdrawals as ordinary income, not capital gains, and applies a 10% penalty if taken before age 59½ (unless in an IRA wrapper).

Types of Annuities Explained (With Pros and Cons)

Fixed Annuities: Are They Just Insurance CDs?

- What they are: Promise a fixed rate of return for a set number of years.

- Pros: Predictability, safety, guaranteed interest.

- Cons: Low returns (often less than Treasuries), surrender charges, and inflation risk.

Variable Annuities: Investment Options With Insurance Wrappers

- What they are: Tie your money to "subaccounts" (mutual-fund-like investments).

- Pros: Market exposure, optional riders for income guarantees.

- Cons: Highest fees of all annuities (3–4% per year), complex prospectuses, and lock-ups.

Indexed Annuities: Market-Like Growth With Caps and Spreads

- What they are: Promise upside tied to an index (e.g., S&P 500), but with participation limits.

- Pros: Downside protection.

- Cons: Caps, spreads, and participation rates limit growth. "Market upside" is often illusory.

Immediate Annuities: Turning a Lump Sum Into Lifetime Income

- What they are: You hand over a lump sum, and the insurer pays a guaranteed monthly amount for life.

- Pros: Lifetime income, simplicity.

- Cons: Irreversible, poor inflation protection, no liquidity.

The Hidden Costs of Annuities: Why They Are So Expensive

Annuity costs stack up fast through M&E charges, admin fees, subaccount expenses, and riders. All-in expenses of 2% to 4% per year are common and can compound into six figures of lost growth.

Understanding Mortality and Expense (M&E) Fees

The mortality and expense charge (often 1.25% annually) is built into most annuity contracts. The insurer markets it as compensation for "insurance risk," but in reality, it's a high-margin fee that reduces your return.

Administrative Fees and Subaccount Expenses

On top of M&E fees, you'll pay:

- Admin fees: 0.10%–0.30% annually.

- Subaccount management fees: 0.50%–1.50%, comparable to those of high-cost mutual funds.

Rider Fees: The Gotcha Costs

Riders for income guarantees or death benefits can add 0.5%-1.5% in extra costs. These optional add-ons are a major profit center for insurers.

Total Fee Burden Example

It's not uncommon for a variable annuity to carry total annual expenses of 3%-4%.

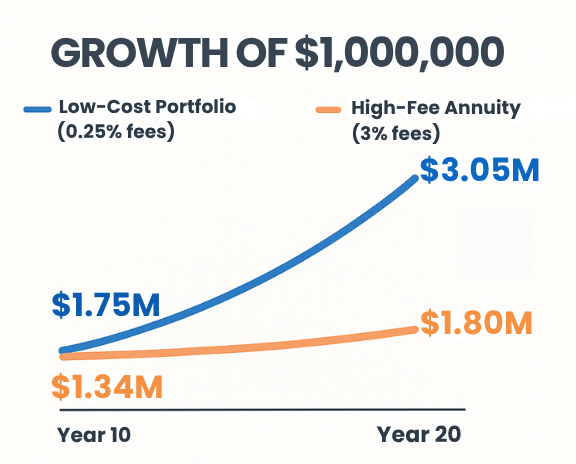

Case Study: 1,000,000 Investment

| Assumptions | Low-cost portfolio | High-fee annuity |

|---|---|---|

| Gross return | 6.0% | 6.0% |

| Annual fees | 0.25% | 3.00% |

| Net return | 5.75% | 3.00% |

| Value at 10 years | $1,749,056 | $1,343,916 |

| Value at 20 years | $3,059,198 | $1,806,111 |

| Difference | At 20 years, the gap is roughly $1,253,087 in lost growth due to higher fees. | |

Visualizing Fee Drag

Impact of fees on $1,000,000 over 20 years: low-cost portfolio vs high-fee annuity.

The Commission Incentives Behind Annuity Sales

Why do some advisors promote annuities so forcefully? This is because commissions can range from 5% to 10% of the premium. For example, a $500,000 contract could result in a salesperson earning $25,000 to $50,000 upfront.

This incentive structure often leads to product-pushing over planning. By contrast, fiduciary advisors (like us) charge transparent flat fees with no product commissions.

FINRA has repeatedly warned investors about the complexity and costs associated with variable annuities, noting that they may not be suitable for most investors.

Surrender Charges: The Lock-Up Trap

Most contracts penalize early withdrawals for 5 to 10 years with declining surrender schedules. These lock-ups limit flexibility when you may need access to your money.

| Year | Surrender charge |

|---|---|

| 1 | 7% |

| 2 | 6% |

| 3 | 5% |

| 4 | 4% |

| 5 | 3% |

| 6+ | 0% |

The Tax Implications of Annuities: What Investors Need to Know

Annuities are often marketed as "tax-advantaged" investments, but the reality is more nuanced. While they do allow for tax deferral, the way withdrawals and inheritances are taxed can create significant drawbacks, especially for high-income investors.

How Are Annuity Earnings Taxed?

Earnings inside an annuity grow on a tax-deferred basis, meaning you won't pay taxes annually on interest, dividends, or capital gains. However, once you start withdrawing, all earnings are taxed as ordinary income, not as long-term capital gains. This distinction is crucial because high earners may face rates of 37% or more, compared to 15–20% on capital gains.

Early Withdrawal Penalties

Withdrawals taken before age 59½ are generally subject to a 10% IRS penalty on top of ordinary income tax. The penalty applies only to the earnings portion, not the original principal.

Qualified vs. Non-Qualified Annuities

Non-Qualified Annuities are funded with after-tax dollars. Only the earnings are taxable at withdrawal, but again at ordinary income rates.

Qualified Annuities are purchased within retirement accounts, such as IRAs or 401(k)s. In this case, both contributions and earnings are fully taxable upon distribution, similar to other withdrawals from retirement plans.

Annuitized Payments and the Exclusion Ratio

If you convert your annuity into a stream of lifetime payments, the IRS applies an exclusion ratio to determine how much of each payment is taxable. Part of each payment is considered a tax-free return of principal, and the rest is taxed as ordinary income.

Inherited Annuities and Taxes at Death

Unlike stocks or real estate, annuities do not receive a step-up in basis at death. Beneficiaries inherit the contract, along with its deferred tax liability, meaning they must pay ordinary income tax on the earnings portion when they receive distributions.

State-Level Taxes

In addition to federal taxes, annuity withdrawals may also be subject to state income taxes. In high-tax states like California and New York, this can result in an additional tax burden of 8–13%.

Bottom Line on Taxes

Annuities defer taxes, but they don't eliminate them, and they often turn tax-efficient gains into higher-taxed ordinary income. For many high-net-worth investors, this trade-off significantly reduces long-term after-tax returns.

When Do Annuities Actually Make Sense?

Despite their flaws, annuities can be appropriate if:

- You don't have a pension and want a guaranteed income for life.

- You've maxed out 401(k)s, IRAs, and other tax-advantaged accounts.

- You value certainty over growth and are comfortable trading liquidity for guarantees.

In such cases, low-cost immediate annuities or fee-only annuities may be suitable options.

The Stanford Center on Longevity and Morningstar research both suggest that plain-vanilla immediate annuities may provide retirement income stability for specific households.

Annuities can fit when you have maximized tax-advantaged accounts, lack a pension, and want guaranteed lifetime income. Prioritize simple, low-cost, no-commission products that meet a clear income need.

Planner tip: If you use an annuity, get competing quotes for immediate annuities and compare the guaranteed payout rate against a low-cost portfolio withdrawal plan. Choose the tool that best solves the specific income gap with the least friction.

Are annuities tax-efficient?

What is the average annuity fee?

Do annuities protect against inflation?

Are there fee-only annuities?

Should I buy an annuity for guaranteed retirement income?

Want a fiduciary second opinion on your annuity?

VIP Wealth Advisors can audit fees, riders, and surrender terms, and design lower-cost, tax-smart alternatives if appropriate.

Book Your VIP Planning CallView More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)