Tokenized stocks do not change what you own, they change the infrastructure that moves, settles, and records ownership behind the scenes.

Key Takeaways

- Tokenized stocks represent traditional securities using modern blockchain-based settlement infrastructure.

- Major exchanges are pursuing tokenization to reduce settlement risk, improve capital efficiency, and modernize global markets.

- For investors, the benefits are indirect and long-term, while early-stage risks remain operational and behavioral.

- This shift affects custody, settlement, and planning, not investment fundamentals or expected returns.

The New York Stock Exchange building a platform for tokenized stocks is not a crypto headline. It is a capital markets headline.

When institutions like the NYSE, Nasdaq, the Depository Trust Company (DTC), BNY Mellon, Citi, and Intercontinental Exchange all start moving in the same direction, it signals something far more important than a new trading product. It signals that the underlying plumbing of financial markets is being rebuilt.

This article explains what tokenized stocks actually are, why major exchanges are pursuing them now, the real upside and downside for investors, and how high-net-worth individuals, tech professionals, and globally mobile investors should think about this shift.

No hype. No evangelism. Just clear thinking.

What Are Tokenized Stocks?

At a high level, tokenized stocks are traditional securities represented in digital form on a blockchain.

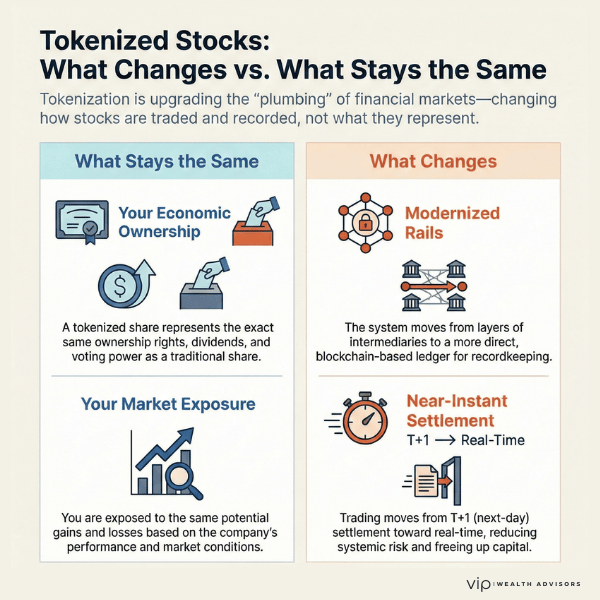

A tokenized share of stock represents the same economic interest as a conventional share. Same ownership rights. Same dividends. Same voting rights. Same exposure to gains and losses.

What changes is not the asset. What changes is the infrastructure used to trade, clear, settle, and record ownership.

Instead of relying on layers of intermediaries, batch processing, and delayed settlement, tokenized securities use blockchain-based ledgers to track ownership and move assets in near real time.

Think of it like the difference between:

- Mailing a paper check versus sending a wire

- Calling a broker versus placing an electronic trade

The asset stays the same. The rails get faster.

Why Are NYSE and Nasdaq Doing This Now?

This move did not come out of nowhere. Several forces are converging at once.

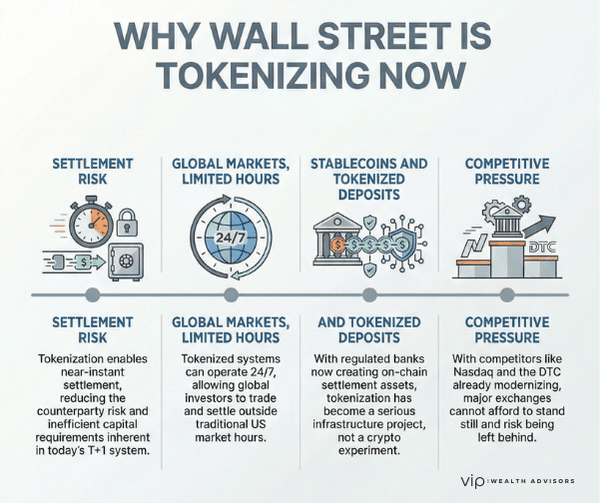

1. Settlement risk is still real

Even with T+1 settlement, markets still rely on delayed reconciliation. That creates counterparty risk, margin requirements, and capital inefficiencies.

Tokenized infrastructure allows exchanges to move toward instant or near-instant settlement, reducing risk and freeing up capital.

2. Markets are global. Market hours are not.

Capital is global. Investors are global. Businesses operate 24/7.

US equity markets still shut down every afternoon.

Tokenized systems enable round-the-clock trading and settlement, especially for international investors who operate outside US banking hours.

3. Stablecoins and tokenized deposits changed the conversation

Early blockchain experiments relied heavily on crypto-native stablecoins. Now, regulated banks like BNY Mellon and Citi are working on tokenized deposits.

That changes everything.

When regulated banks support on-chain settlement assets, tokenization becomes a market infrastructure project, not a crypto experiment.

4. Competitive pressure

Nasdaq has already applied to the SEC to support tokenized stocks. The DTC has received approval to support tokenized securities beginning in 2026.

The NYSE cannot afford to stand still while competitors modernize.

How the NYSE Tokenized Platform Will Likely Work

While final details depend on regulatory approval, the proposed NYSE platform has several defining characteristics.

- A separate trading venue for tokenized securities

- Integration of NYSE's existing Pillar matching engine

- Blockchain-based post-trade infrastructure

- Dollar-denominated orders

- Stablecoin or tokenized deposit funding

- Potential support for multiple blockchains

This would be a regulated exchange environment, not a decentralized free-for-all.

This is Wall Street adopting new rails, not abandoning rules.

The Real Upside for Investors

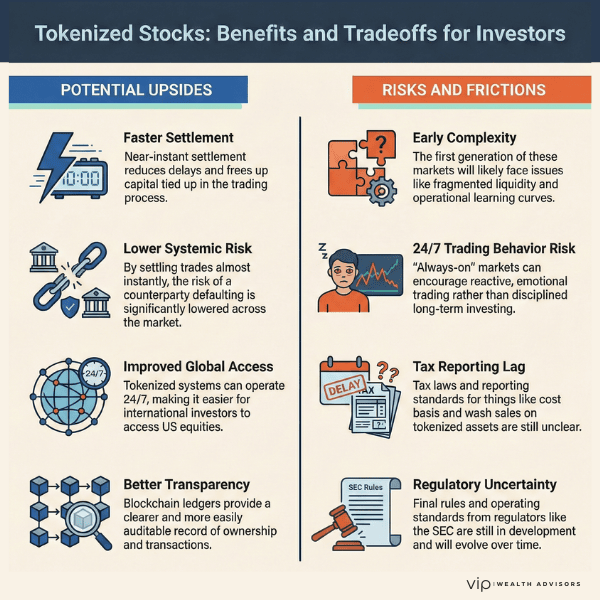

1. Faster settlement and lower systemic risk

Delayed settlement creates hidden risk. It also ties up capital.

If trades can settle instantly:

- Counterparty exposure drops

- Margin requirements decline

- Capital efficiency improves

Over time, that benefits long-term investors more than short-term traders.

2. Lower costs in the long run

Every intermediary takes a slice.

Tokenized infrastructure has the potential to:

- Reduce clearing and settlement costs

- Simplify reconciliation

- Lower operational overhead

Those savings do not show up overnight, but infrastructure improvements compound over time.

3. Improved access for global investors

Tokenized markets make it easier for:

- Non-US investors to access US equities

- Capital to move outside traditional banking hours

- Cross-border settlement to occur with fewer frictions

This matters for executives, founders, and investors with international exposure.

4. Better transparency at the settlement layer

Blockchain-based systems offer clearer audit trails and ownership records.

That improves:

- Operational integrity

- Regulatory oversight

- Confidence in the system

Again, not exciting. But extremely important.

The Downsides and Risks Investors Should Not Ignore

1. Early-stage complexity

The first generation of tokenized stock markets will be messy.

Expect:

- Fragmented liquidity across venues

- Confusion around custody

- Reporting and tax friction

- Operational learning curves

Sophisticated investors should let institutions work through these issues before engaging directly.

2. Behavioral risk from 24/7 trading

Markets closing is not a bug. It is a feature.

Always-on trading:

- Encourages reactive behavior

- Increases emotional decision-making

- Benefits professional traders more than long-term investors

Access does not equal advantage.

3. Tax reporting will lag innovation

Tax law moves more slowly than technology.

Key open questions include:

- Cost basis reporting

- Wash sale treatment

- Corporate actions on tokenized shares

- Trust and estate reporting

Until this becomes boring, it will remain complex.

4. Regulatory uncertainty remains

SEC approval is required. Standards will evolve. Rules will be clarified over time.

That process will be incremental, not revolutionary.

How High-Net-Worth Clients Should Think About Tokenized Stocks

Tokenization is infrastructure, not an asset class.

Clients do not need to buy tokenized stocks to benefit from tokenized markets.

This will matter more for custody, settlement, and liquidity than returns.

Returns still come from:

- Business fundamentals

- Asset allocation

- Tax efficiency

- Risk management

Better plumbing improves outcomes indirectly.

Most investors should wait

Early adopters pay tuition.

For most clients, the correct posture is:

- Stay informed

- Avoid experimentation

- Let systems mature

What This Means for Financial Planning

Over time, tokenized markets may:

- Reduce settlement delays for liquidity planning

- Improve cross-border investment efficiency

- Change custody and reporting workflows

- Influence how equity compensation is settled

Advisors will need to understand the infrastructure even if clients never touch it directly.

What Investors Should Actually Take Away From This

Tokenized stocks do not change what you own. They change how markets work behind the scenes.

If successful, this shift makes markets faster, cheaper, and safer.

If unsuccessful, it will fail slowly and quietly.

Either way, long-term investors do not need to act. They need to understand.

Frequently Asked Questions (FAQ)

+What are tokenized stocks?

Tokenized stocks are traditional securities represented digitally on a blockchain. They provide the same economic and ownership rights as conventional shares but use modern infrastructure for trading and settlement.

+Are tokenized stocks the same as cryptocurrencies?

No. Tokenized stocks are regulated securities. Cryptocurrencies are separate assets with different legal, regulatory, and risk profiles.

+Will tokenized stocks replace traditional stocks?

Over time, tokenized infrastructure may replace parts of the existing settlement system. The underlying securities themselves are unlikely to disappear.

+Can investors trade tokenized stocks 24/7?

Potentially, yes. However, 24/7 access does not necessarily improve long-term investment outcomes.

+Are tokenized stocks safe?

They are expected to operate within regulated exchange environments, but early-stage systems always carry operational risk.

+Will tokenized stocks lower investment costs?

Over the long term, improved infrastructure may reduce clearing and settlement costs, thereby benefiting investors indirectly.

+How are tokenized stocks taxed?

Tax treatment is expected to mirror traditional securities, but reporting and compliance standards are still evolving.

+Should individual investors buy tokenized stocks now?

Most investors should wait. This is an infrastructure evolution, not a speculative opportunity.

+How does this affect equity compensation?

Tokenized settlement could eventually impact how RSUs and stock options are delivered and settled, but no immediate changes are expected.

+What should investors do today?

Stay informed, focus on fundamentals, and let professionals handle the infrastructure changes.

How This Fits Into Your Bigger Financial Picture

Infrastructure changes rarely require immediate action, but they do affect how liquidity, taxes, custody, and equity compensation are planned over time.

If you want to understand how market structure changes intersect with your broader financial strategy, a focused conversation can help clarify what matters and what does not.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)