A high private-market IRR can look impressive, but without understanding liquidity, fees, timing, and actual wealth creation, it can be deeply misleading

Key Takeaways

- IRR measures timing, not total wealth creation, and can be inflated by structural features of private markets.

- MOIC provides clearer insight into whether real value was created.

- Liquidity risk is the most underappreciated cost of private investments.

- Fees materially reduce net outcomes and must be evaluated alongside returns.

- Private investments should complement a portfolio, not dominate it.

A 24% internal rate of return sounds incredible.

On paper, it dwarfs the S&P 500. It beats most hedge funds. It makes traditional portfolios look sleepy. And it is the kind of number that shows up again and again in private investment pitch decks, especially in private equity, venture capital, private credit, and other alternative investments.

So the obvious question is: if these deals really generate returns of 15% to 25% annually, why not allocate a large portion of your portfolio to them?

This article exists to answer that question honestly.

While private-market IRRs are not fabricated, they are frequently misunderstood. And misunderstanding them can lead to overconfidence, over-allocation, and avoidable financial stress.

This article presents a detailed explanation of how private investment returns actually work, what IRR measures and does not, how liquidity and timing distort comparisons to public markets, and how sophisticated investors evaluate whether a private deal truly earns its place in a portfolio.

The first mistake investors make: comparing private IRR to public market returns

The most common error investors make is comparing a private investment's IRR directly to the long-term return of the S&P 500.

At a glance, it feels intuitive:

- The S&P 500 has historically returned around 9% to 10% nominally.

- A private deal claims an IRR of 20% or 24%.

But this comparison is fundamentally flawed.

Public market returns are:

- fully liquid

- continuously priced

- marked to market daily

- available for rebalancing at any time

Private investment IRRs are:

- illiquid

- smoothed

- model-driven

- path-dependent

- unavailable when markets are stressed

They are not the same economic experience.

What IRR actually measures (and what it quietly ignores)

IRR measures the annualized rate of return of a series of cash flows. It answers one narrow question:

How quickly did invested capital turn into distributed capital?

IRR is extremely sensitive to timing. Small changes in when cash is returned can dramatically change the IRR, even if the total dollars returned barely move.

For example:

- Returning $1.30 quickly can produce a very high IRR.

- Returning $2.00 slowly can produce a much lower IRR.

IRR does not care about:

- how long capital was locked

- how volatile the underlying asset was

- whether capital could be redeployed

- whether losses were masked by valuation smoothing

- whether the investor could exit if circumstances changed

This is why IRR is often flattering in private markets.

Why private market IRRs are structurally inflated

Private investment returns are not dishonest, but they are structurally biased upward for several reasons.

1. Valuation smoothing

Private assets are not priced daily. Losses tend to appear late, gradually, or only at exit. Public markets absorb volatility in real time. Private markets defer it.

This makes private returns look smoother and more attractive on paper, even if the economic risk is similar.

2. Capital call timing

Capital is not invested on day one. IRR calculations often begin only after capital is called, which reduces the apparent time capital is at risk.

3. Subscription lines of credit

Funds often use short-term borrowing to delay capital calls. This boosts IRR without changing the ultimate outcome for investors.

4. Recycling and early distributions

Some funds return capital early and recycle it. This can significantly increase IRR even if total wealth creation is modest.

None of this is improper. But all of it matters when interpreting returns.

MOIC matters more than most investors realize

MOIC, or multiple on invested capital, answers a simpler question:

How many dollars did I get back for every dollar I invested?

A 1.7x MOIC means $100 invested became $170.

MOIC does not care about time. It does not care about timing tricks. It measures actual wealth creation.

This is why sophisticated investors look at IRR and MOIC together.

- High IRR with low MOIC often indicates timing effects, not extraordinary value creation.

- High MOIC with moderate IRR often indicates patient, durable compounding.

When evaluating private deals, MOIC tells you whether value was actually created. IRR tells you how quickly the story played out.

The risk that IRR never prices in: liquidity

Liquidity is not a footnote. It is the defining risk of private investing.

When you commit capital to a private deal, you give up:

- the ability to rebalance

- the ability to exit during stress

- the ability to harvest losses

- the ability to redeploy capital opportunistically

That optionality has real value.

During market downturns, private exits slow or stop. Capital calls continue. Distributions pause. Investors often discover they are illiquid at the worst possible time.

IRR does not account for this risk. But investors feel it acutely.

Why investors cannot simply allocate 50% to private deals

If private investments truly outperform, why not allocate aggressively?

Because portfolios are not built on return alone.

They are built on:

- liquidity needs

- cash flow timing

- behavioral resilience

- concentration limits

- risk management

Even large endowments with elite access and long time horizons rarely exceed 30% to 40% illiquid exposure. Individual investors should typically remain well below that.

Private investments concentrate risk in ways that are not obvious until something breaks.

Fees: the silent return killer most investors underestimate

Private investment returns do not exist in a vacuum. They are inseparable from fees. And this is where many investors dramatically misjudge the true economics of private deals.

Most private equity, venture capital, and alternative funds follow the classic "two and twenty" model:

- 2% annual management fee on committed or invested capital

- 20% carried interest on profits, typically after a preferred return

At first glance, this structure feels abstract. But compared to low-cost public market exposure, the difference is enormous.

For perspective:

- Vanguard's Total Stock Market ETF (VTI) charges 0.03% annually

- A traditional private fund may charge 2% every year for a decade, plus 20% of upside

These are not comparable cost structures. And investors must understand why private fees are so high, what they pay for, and when they are justified.

Why are private investment fees so much higher?

Private markets are labor-intensive businesses.

Fund managers are not simply tracking an index. They are:

- sourcing proprietary deals

- performing deep operational diligence

- structuring complex transactions

- actively managing portfolio companies

- negotiating exits

- providing ongoing governance

These activities require teams, legal infrastructure, travel, advisory support, and time. The fee structure reflects that reality.

That said, high fees are not automatically justified by complexity. They are justified only if the manager produces net outcomes that investors cannot reasonably replicate elsewhere.

Management fees vs carried interest

It is critical to separate the two components.

Management fees cover the costs of running the fund. They are charged regardless of performance. Over a 10-year fund life, a 2% management fee can consume 15% to 20% of total committed capital.

Carried interest is performance-based. It is paid only if profits exceed the hurdle rate. This aligns incentives, but it also means that in strong outcomes, a significant portion of upside goes to the GP.

Both matter. Together, they can dramatically reduce what investors actually keep.

Net vs gross returns: the most important disclosure investors must verify

One of the most common sources of confusion in private investment marketing is whether stated returns are gross or net of fees.

This distinction is not cosmetic. It is everything.

-

Gross returns are calculated before management fees, carry, fund expenses, and often before financing costs.

-

Net returns reflect what investors actually receive after all fees.

A fund showing a 24% gross IRR may deliver a much lower net outcome to investors.

Sophisticated investors care only about net, after-fee, after-expense returns.

How IRR is often marketed

Private investment IRRs are frequently presented in the most flattering way possible:

- using gross figures

- highlighting early cash flows

- assuming optimistic exit timing

- excluding the impact of subscription lines

- emphasizing best-performing vintages

Again, this is not necessarily deceptive. But it is selective.

Investors must dig deeper.

The right questions investors should ask about fees and returns

Before allocating to any private deal, investors should ask:

- Are the stated returns net or gross of all fees?

- How are management fees calculated: committed capital or invested capital?

- How long do management fees persist after the investment period?

- What expenses are charged at the fund level in addition to stated fees?

- Is carried interest subject to a preferred return and clawback?

- How much of historical performance is realized vs unrealized?

- How does the fee structure compare to the complexity and value added?

- How sensitive are returns to fee drag in mediocre outcomes?

These questions matter because fees compound just as returns do.

Fees vs public markets: the comparison investors must make honestly

Comparing private investment returns to public markets without adjusting for fees and liquidity is misleading.

A low-cost ETF like VTI:

- offers daily liquidity

- full transparency

- near-zero fees

- effortless diversification

Private investments demand:

- long lockups

- opaque valuation

- complexity

- high fees

The return premium must be sufficient to compensate for all of this.

If a private deal cannot reasonably be expected to outperform public markets after fees and liquidity risk, it does not deserve capital.

How sophisticated investors think about private fees

Experienced allocators accept high fees only when:

- access is genuinely scarce

- skill dispersion is real

- net returns are meaningfully superior

- diversification benefits exist

They avoid private deals where fees absorb most of the value created.

They also size private allocations conservatively, recognizing that fees reduce flexibility and amplify mistakes.

How sophisticated investors evaluate private returns

Experienced allocators do not chase headline IRRs.

They ask:

- Are returns net of all fees?

- How much has been realized versus what has been marked?

- What was peak capital at risk?

- How did the strategy perform in down markets?

- How correlated are outcomes across managers?

- Does this improve the portfolio, or simply add complexity?

They model pessimistic scenarios. They assume exits are delayed. They stress-test liquidity.

That discipline matters more than the stated return.

The uncomfortable truth about private investment marketing

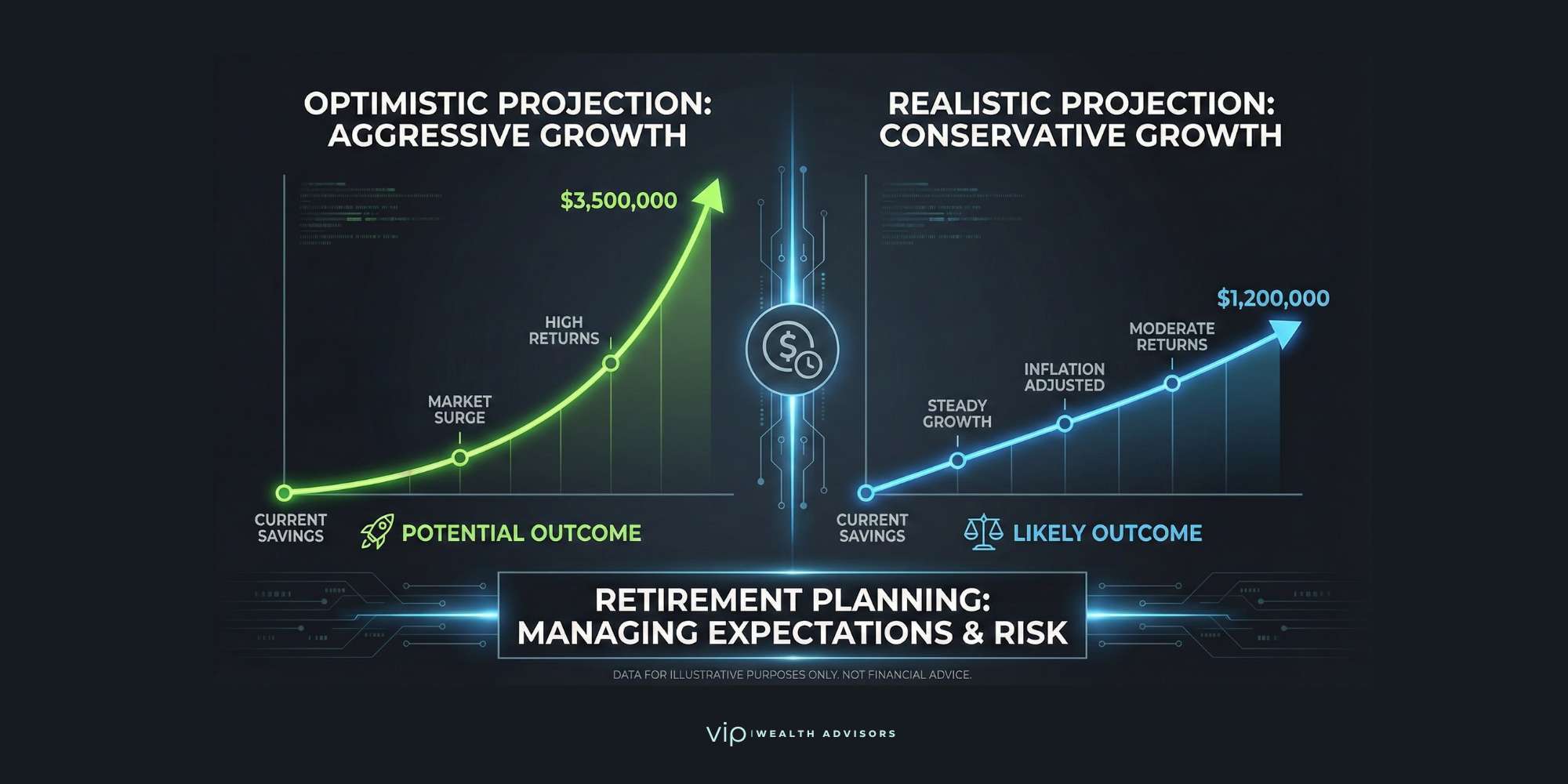

Private investment returns are often presented as point estimates rather than ranges.

A pitch deck may say 20% IRR, but the real experience might be:

- 8% in a bad scenario

- 12% to 15% in a base case

- 20%+ only if conditions cooperate

Public markets show volatility honestly. Private markets show confidence.

Understanding that difference protects investors from over-allocation.

The right way to think about private investments

Private investments should not be judged on whether they beat the S&P 500 in isolation.

They should be evaluated on whether they:

- complement public market exposure

- improve long-term outcomes

- add differentiated return drivers

- fit liquidity and life constraints

The goal is not to maximize IRR.

The goal is to build a resilient portfolio that works across cycles.

Returns Without Context Are Just Marketing

A 24% IRR is not meaningless. But it is not self-explanatory.

Private investment returns must be understood in context: timing, liquidity, valuation, and risk all matter.

Sophisticated investors do not dismiss private markets. They also do not worship them.

They treat private investments as powerful tools that must be sized correctly, evaluated rigorously, and integrated thoughtfully.

That mindset matters far more than any single headline return.

Common questions investors ask about private investment returns

+ Is IRR a reliable measure of private investment performance?

IRR is useful but incomplete. It must be evaluated alongside MOIC, cash flow timing, and liquidity risk.

+ Why do private deals often show higher returns than public markets?

Private returns benefit from valuation smoothing, illiquidity premiums, and timing effects that do not exist in public markets.

+ What is a good MOIC for private investments?

This depends on strategy, but net MOICs of 1.5x to 2.0x are generally considered strong for lower-risk private strategies.

+ How much of a portfolio should be allocated to private investments?

This varies by net worth, cash flow, and risk tolerance, but most individual investors should limit illiquid exposure to a minority of their portfolio.

+ How can investors verify stated private returns?

Look for net returns, realized outcomes, consistency across vintages, and transparency in fee structures.

+ Are private investments riskier than public markets?

They are risky in different ways. The primary risks are illiquidity, opacity, and timing rather than daily volatility.

Thinking About a Private Investment?

If you are evaluating private equity, venture capital, or alternative investments and want to understand how returns, liquidity, and fees truly affect your portfolio, a structured conversation matters.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)