Investors do not need certainty about AI's future - they need portfolios that can survive if expectations change.

Key Takeaways

- You can be right about AI and still lose money if you are overexposed to the narrative.

- Most AI exposure today is concentrated in U.S. large growth stocks, even in index portfolios.

- Diversification reduces reliance on any single outcome without requiring perfect timing.

- Bonds and cash provide stability and optionality during periods of excessive optimism.

- Resilient portfolios are built for multiple futures, not single predictions.

Artificial intelligence is everywhere. Earnings calls, investor decks, dinner conversations, client meetings.

And inevitably, the question comes up:

"Is AI in a bubble?"

It is a fair question. But it is also the wrong one.

The more important question investors should be asking is this:

What happens to my portfolio if the enthusiasm fades?

Because history is clear on one thing, you do not need to be wrong about the technology to lose money. You only need to be overexposed to the narrative.

At VIP Wealth Advisors, we do not build portfolios based on headlines or hype cycles. We build them to survive multiple futures. That distinction matters more today than it has in years.

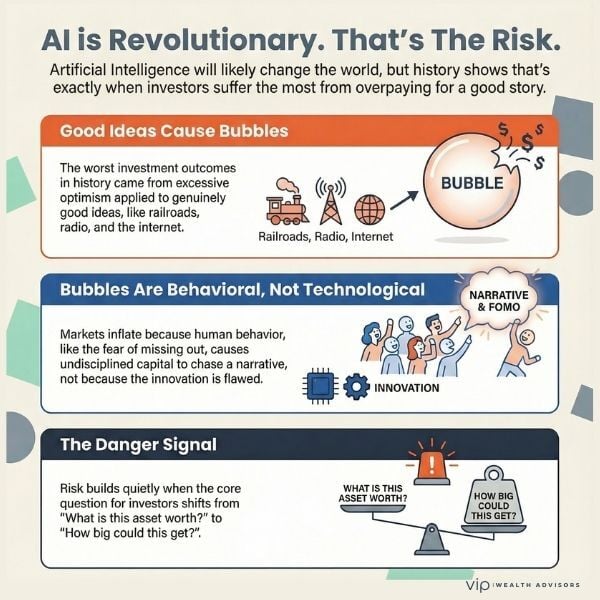

AI Is Revolutionary. That Is Exactly Why Investors Should Be Careful.

Some of the worst investment outcomes in history came from being early and right.

Railroads reshaped America. Radio changed communication. Aviation shrank the world. The internet transformed nearly every industry it touched.

All of those technologies delivered extraordinary long-term value to society.

And all of them coincided with periods when investors dramatically overpaid for growth, chased stories rather than cash flows, and suffered significant losses when expectations collided with reality.

This is not a contradiction. It is a pattern.

Howard Marks has made this point repeatedly. Bad ideas do not cause bubbles. They are caused by excessive optimism applied to good ideas.

AI fits that mold perfectly.

It is genuinely transformative. It is also being wrapped in narratives that imply inevitability, speed, and unlimited upside. When that happens, valuation discipline weakens and capital floods in faster than fundamentals can justify.

That does not mean AI will fail.

It means investors need to separate belief in the technology from dependence on it.

Bubbles Are Behavioral, Not Technological

Markets do not inflate because innovation exists. They inflate because human behavior does not change.

The pattern is familiar:

- A new technology captures the imagination

- Early investors are rewarded

- Late investors feel regret and fear of missing out

- Capital becomes abundant and undisciplined

- Price becomes the proof of validity

At that point, the question stops being "What is this worth?" and becomes "How big could this get?"

That is when risk quietly builds.

The most dangerous phase of any bubble is not the beginning. It is the middle, when skepticism fades but certainty has not yet been tested.

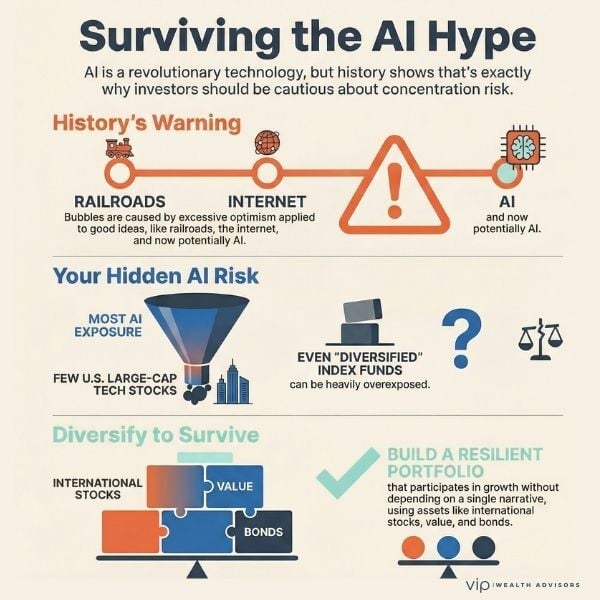

Where AI Exposure Actually Lives in Most Portfolios

Many investors believe they are diversified because they own index funds, broad ETFs, or multiple managers.

But diversification is not about the number of holdings. It is about independent sources of return.

This is where AI risk becomes concentrated.

Today, the overwhelming majority of public market AI exposure sits in U.S. large growth stocks, particularly mega-cap technology companies. These firms dominate index weightings, earnings growth expectations, and narrative momentum.

Even diversified-looking portfolios can be structurally dependent on one narrow segment of the market.

- Index investors often have far more exposure to AI than they realize

- Portfolio outcomes become increasingly dependent on a narrow segment of the market

- Correlations rise during periods of stress, not fall

Even if AI succeeds as a technology, that does not guarantee strong investor outcomes at current valuations.

History shows that when enthusiasm fades, it is not the technology that gets repriced. It is the expectations embedded in stock prices.

The Real Risk Is Not Being Wrong About AI

The real risk is being undiversified while being wrong about timing.

Many investors believe staying heavily allocated to U.S. large growth is a neutral decision. It is not.

It is an active bet that:

- Valuations will remain elevated

- Capital costs will stay favorable

- Competitive advantages will persist

- The current leaders will remain the leaders

Those assumptions may prove correct. But concentration means they must all remain correct at the same time.

Diversification exists because investors do not get paid for precision. They get paid for resilience.

Why Doing Nothing Is Often the Riskiest Move

One of the most common behavioral traps investors fall into is confusing familiarity with safety.

U.S. large growth stocks feel safe because they have worked. They are well known. They dominate headlines and portfolios.

But concentration rarely feels risky until it is.

By the time investors recognize the risk, the opportunity to rebalance calmly is gone. Decisions become reactive. Emotions take over. Discipline breaks down.

This is why we view diversification as a proactive strategy, not a defensive one.

What a Properly Allocated Portfolio Is Designed to Do

A well-constructed portfolio is not designed to predict the future. It is designed to remain functional across many futures.

- Participating in growth without relying on one narrative

- Owning assets that respond differently to economic conditions

- Reducing the probability of permanent capital loss

Diversification does not mean avoiding AI. It means not needing AI to be right right now.

How Diversification De-Risks U.S. Large Growth Exposure

A properly allocated portfolio spreads risk across asset classes, investment styles, and geographies.

Each plays a role:

Small Cap Stocks

Smaller companies are often more sensitive to domestic economic growth and benefit from different stages of the business cycle. They do not move in lockstep with mega-cap technology.

Value Stocks

Value-oriented companies tend to anchor returns to cash flow, dividends, and valuation discipline. They historically behave differently when growth expectations are repriced.

International Equities

Innovation does not live exclusively in the United States. International markets diversify currency exposure, economic regimes, and policy environments.

Emerging Markets

Emerging economies offer exposure to different growth drivers, demographics, and adoption curves that are not dependent on Silicon Valley narratives.

Together, these allocations reduce the portfolio's reliance on any single outcome.

Why Bonds and Cash Still Matter in an AI-Driven World

Bonds and cash are often misunderstood.

They are not return engines. They are risk management tools.

High-quality bonds have historically:

- Provided stability during equity drawdowns

- Offered liquidity when investors needed flexibility

- Enabled rebalancing opportunities when volatility rises

Cash, when used intentionally, is not idle. It is optionality.

Liquidity allows investors to avoid forced selling, maintain discipline, and take advantage of opportunities when markets are stressed.

In periods of excessive optimism, these stabilizing assets quietly do their job.

How a 90/10 Portfolio Structure Manages AI Risk

A 90 percent equity, 10 percent fixed income portfolio is still growth-oriented. It is not conservative.

But it is structured so that:

- No single asset class determines success or failure

- Rebalancing trims excess enthusiasm naturally

- Investors are not required to predict market tops or bottoms

This approach allows participation in innovation while limiting the cost of being wrong.

That balance matters.

Why Predicting Bubbles Is the Wrong Job for Investors

Bubbles are easy to identify in hindsight. They are almost impossible to time in real time.

Even experienced investors get caught. Often because they were directionally correct but structurally exposed.

At VIP Wealth Advisors, we do not believe the solution is better predictions. We believe the solution is better process.

A disciplined allocation strategy does not need to know whether AI is in a bubble. It simply respects the possibility.

How VIP Wealth Advisors Thinks About AI and Portfolio Risk

We approach AI the same way we approach every major investment trend:

- With curiosity, not fear

- With discipline, not excitement

- With structure, not speculation

Our role is not to chase narratives. It is to steward capital across decades.

That means building portfolios that can withstand enthusiasm, disappointment, and everything in between.

You Do Not Need to Know If AI Is a Bubble

AI may change the world. It likely will.

That does not mean investors should bet their financial future on one asset class, one story, or one outcome.

Diversification is not about pessimism. It is about humility.

It is how long-term investors stay in the game when narratives change.

AI Bubble and Diversification FAQs

+ Is AI currently in a stock market bubble?

No one can say with certainty. AI shows many characteristics associated with past bubbles, including extreme enthusiasm, high valuations, and narrative-driven investing. Whether it becomes a full bubble is only clear in hindsight.

+ Should investors avoid AI stocks entirely?

No. Avoiding AI completely risks missing long-term innovation. The greater risk is overconcentration. Balanced exposure within a diversified portfolio is typically more prudent.

+ Why is AI risk concentrated in U.S. large growth stocks?

Most public AI leaders are large U.S. technology companies that dominate index weightings. This creates hidden concentration even in portfolios that appear diversified.

+ How does diversification help if AI continues to grow?

Diversification allows investors to participate in growth while reducing reliance on one outcome. It preserves upside without requiring perfect timing or valuation precision.

+ Are bonds still relevant in a technology-driven market?

Yes. Bonds provide stability, liquidity, and behavioral support during periods of equity volatility. They help investors remain disciplined when markets become emotional.

+ What is the biggest mistake investors make during hype cycles?

Confusing recent performance with safety. Concentration feels comfortable until it is tested. Diversification addresses this risk before it becomes visible.

+ How does VIP Wealth Advisors manage bubble risk?

We focus on disciplined asset allocation, rebalancing, and behavioral coaching. Our goal is not to predict bubbles but to build portfolios resilient to them.

Concerned your portfolio may be too exposed to one narrative?

This article raises the right question. The next step is understanding how your own portfolio would respond if expectations change.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)