The markets feel precarious. Headlines warn of an AI-driven bubble. Investors are nervous, scanning for safe ground, and gold and silver are once again taking center stage.

But at VIP Wealth Advisors, we don't respond to noise. We look at facts, data, historical returns, and real-world outcomes.

And when you sift through those facts, a very different picture emerges about precious metals than what the hype suggests.

Let's break it down with clarity, math, and no mythology.

The Narrative: "Gold Protects You When Markets Are Frothy"

Gold's emotional appeal is powerful:

- It's tangible

- It's ancient

- It's marketed as a safe haven

- It's perceived as inflation-proof

- It "feels" like wealth

And yes, during extreme macro stress, gold can spike sharply.

But what most investors don't see is how gold behaves over complete cycles, or how often it goes for long periods producing flat to negative real returns.

That's where the data becomes incredibly important.

The Fact Check: Gold's Real Return Over ~60 Years Is Shockingly Low

When economists run long-term inflation-adjusted analyses on gold from the 1960s through today, the results are almost always the same:

Gold's real return over the last six decades sits roughly around 1% annually, sometimes even less depending on the measurement period.

Compare that to:

- U.S. Equities: ~7% real annual return

- U.S. Bonds: ~2% real annual return

- 60/40 Portfolio: ~5% real annual return

Gold barely clears inflation.

And that's before considering:

- Zero yield

- Storage and insurance

- Spreads and transaction costs

- Extreme volatility

This leads many analysts to conclude that gold is less an investment and more of an insurance policy, but even that metaphor requires nuance.

Why the Real Return Is So Low: Gold Produces No Cash Flow

Gold is not a business.

It does not:

- Generate earnings

- Produce dividends

- Expand capacity

- Innovate

- Reinvent itself

Its return is 100% dependent on someone paying you more later, which makes it more of a gamble than an investment over the long term.

Meanwhile, stocks compound through reinvested earnings, buybacks, and productivity growth. This is why, over the decades, equities have dramatically outperformed gold, even through massive crises.

But Gold Does Do Something Very Important

Despite its weak long-term return, gold plays a unique role:

Gold historically performs well when:

- Real interest rates fall

- The dollar weakens

- Inflation surprises to the upside

- Geopolitical risk spikes

- Market fear surges

In these moments, gold can be an effective hedge and a volatility dampener when used strategically.

The keyword: strategically.

Gold works best when it is:

- A slice, not a core, of a diversified portfolio

- Allocated with intention

- Rebalanced periodically

- Understood for what it is: a hedge, not a growth engine

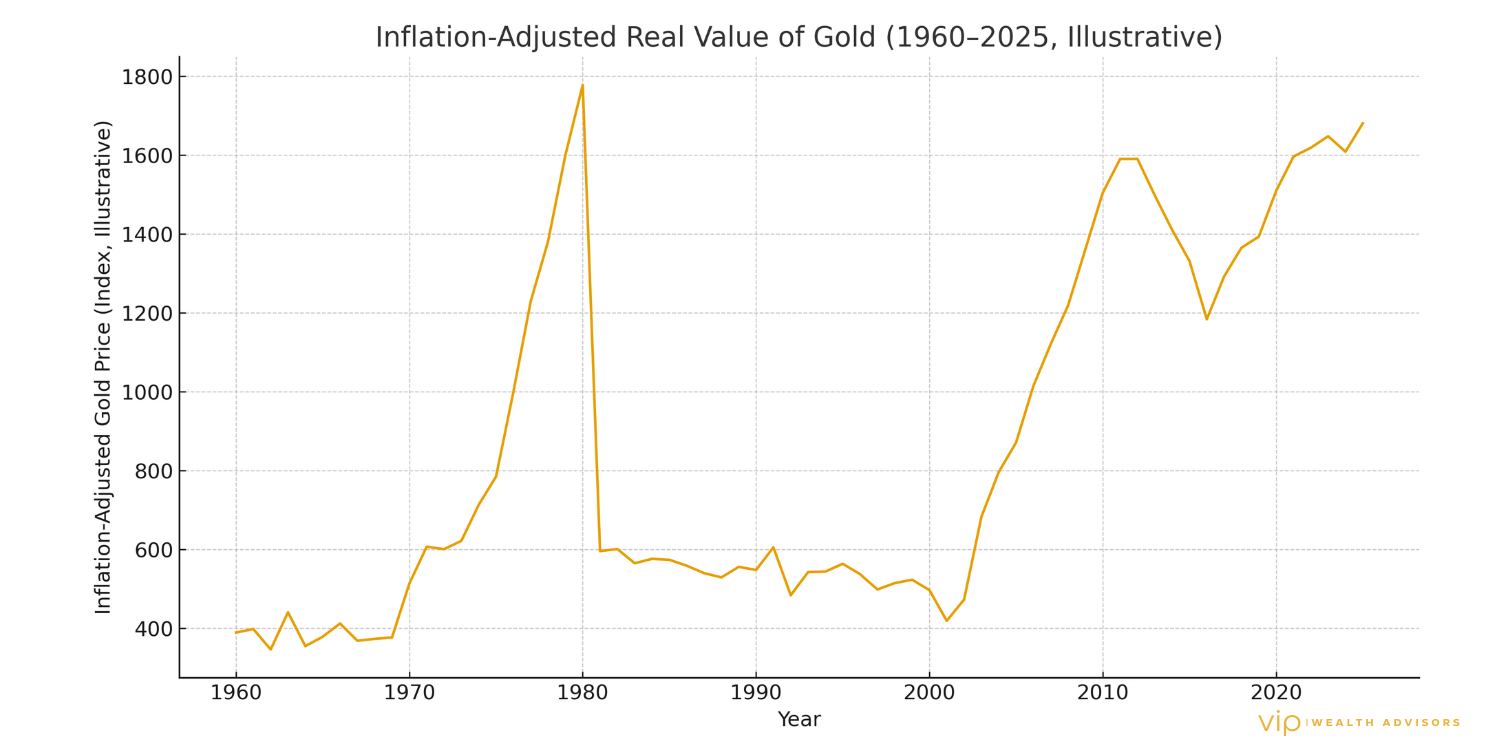

The Chart Every Gold Investor Needs to See

Below is the inflation-adjusted price of gold from 1960 to 2025 (illustrative, for educational use).

This type of chart is typically eye-opening for investors because it shows:

- Massive boom-bust cycles

- Long stretches of real drawdowns

- A pattern of volatility that often exceeds equities

Historical Reality: Gold's Journey Has Been Anything But Stable

Let's look at the major cycles:

1960–1971:

Gold flat. No real return.

1971–1980:

The great inflation. Gold has its strongest decade ever.

1980–2000:

A 20-year real decline.

Investors who bought at the 1980 peak had to wait 28 years to break even in real terms.

2000–2011:

China's growth, dollar weakness, and financial crisis. Another massive run.

2011–2015:

50% absolute drawdown.

2015–2025:

A slow grind higher, punctuated by spikes.

This is not "stable."

This is high volatility with long periods of dormancy.

Silver: The Even Wilder Cousin

If gold is volatile, silver is chaos.

- Extremely cyclical

- Industrial demand is highly variable

- Volatility 2–3× higher than gold

- Long periods of stagnation

- Prone to speculative retail-driven spikes

This can create opportunities, but also brutal drawdowns.

Silver is rarely an appropriate allocation for most long-term investors.

What the Facts Suggest, Not the Headlines

What the facts actually say about precious metals

1. Gold is not a long-term wealth builder.

It does not compound.

It barely outpaces inflation over multi-decade periods.

2. Gold is a valuable hedge during specific macro regimes.

Its role is not return generation, it's risk mitigation.

3. Allocating 3–10% to gold can improve portfolio efficiency.

Under certain conditions, gold can lower risk without severely harming returns.

4. Silver should generally be viewed as a trading asset, not a strategic holding.

5. Precious metals should never replace equities, fixed income, or diversified alternatives.

6. Emotional investing is dangerous; data-driven allocation wins.

At VIP Wealth Advisors, our role is to ensure that clients invest based on facts, evidence, and long-term outcomes, not narratives.

So What Should Investors Do Today?

Given the 2025 landscape, AI exuberance, elevated valuations, election-year uncertainty, and rate policy change, owning a measured precious metals allocation can be reasonable.

But shifting significant levels of capital into gold or silver?

History suggests that it is rarely a winning strategy.

A well-constructed plan does not react; it anticipates.

And diversification is still the best risk management tool ever invented.

How This Fits into a Modern Wealth Strategy

Precious metals have a place.

But they are not the place.

Your financial plan should be constructed like a pyramid:

- Base: Cash flow, liquidity, and safety reserves

- Core: Equities, bonds, tax-efficient growth

- Satellite: Alternatives, alts, hedges, including gold

- Peak: Speculative or thematic positions

Gold lives in the satellite category, not the foundation.

When used responsibly, it can strengthen portfolios.

When used reactively, it can derail long-term goals.

Q&A Section:

Q Q1: Is gold a good inflation hedge?

Gold protects against unexpected inflation, not normal inflation. Over long periods, gold only slightly beats inflation.

Q Q2: How much gold should I have in my portfolio?

Most evidence-based allocation frameworks suggest a range of ~3–10% depending on risk profile, time horizon, and macro exposure.

Q Q3: Is silver a better investment than gold?

No. Silver is far more volatile and heavily tied to industrial production cycles. It's generally better for tactical rather than strategic use.

Q Q4: Should I buy physical gold or ETFs?

ETFs are liquid, efficient, and easy to rebalance.

Physical gold is useful for collectors or for psychological comfort, not portfolio optimization.

Q Q5: Is now a good time to buy gold?

It depends on your plan, not the news cycle.

Gold works best as part of a consistent allocation, not a reactionary move.

Q Q6: Could gold outperform stocks?

It has, during short extreme periods (1970s, 2000–2011), but over the long run, equities have dramatically outperformed gold.

Q Q7: What about gold miners?

Gold miners correlate with gold but also carry equity, operational, and leverage risks. They're not a substitute for gold itself.

Thinking about loading up on gold or silver?

Before you shift serious capital into precious metals, make sure the move fits your long-term plan, your tax picture, and your actual risk tolerance - not the headlines.

We help high-income investors stress-test their portfolios, quantify the real role gold and silver should play, and build evidence-based strategies that survive more than one market cycle.

View More Articles by Topic

- Taxes (81)

- Financial Planning (46)

- Equity Compensation (38)

- Investments (30)

- RSU (23)

- Tax Policy & Legislation (19)

- Business Owner Planning (17)

- Incentive Stock Options (16)

- Retirement (16)

- Psychology of Money (15)

- Alternative Investments (13)

- AMT (9)

- Pre-IPO Planning (9)

- Real Estate (9)

- Estate Planning (8)

- Fiduciary Standard (8)

- Crypto (6)

- NSOs (6)

- The Boring Investment Strategy (6)

- Capital Gains Tax (5)

- Private Investments (5)

- QSBS (5)

- Market Insights (4)

- Post-IPO Tax Strategy (4)

- 401(k) Strategy (3)

- Market Timing (3)

- Q&A (3)

- Stock Market (3)

- Venture Capital (3)

- Altruist (2)

- Charitable Giving (2)

- ETF Taxes (2)

- IRA Strategy (2)

- International Financial Strategies (2)

- Irrevocable Trust (2)

- Legacy Wealth (2)

- Video (2)

- AUM vs Flat Fee (1)

- Atlanta (1)

- Book Review (1)

- Carried Interest Planning (1)

- Depreciation & Deductions (1)

- Education Planning (1)

- Energy Markets (1)

- Precious Metals (1)

- QTIP Trust (1)

- Revocable Trust (1)

- Risk Management (1)

- Schwab (1)

- Solo 401k (1)